India’s sports fabric market is valued at approximately US $1.66 billion, with polyester accounting for 60% (around US $1 billion). Within this, Dry-Fit microfibre (0.5–1.2 dpf) represents 50–70% share (US $500–700 million).

Global players are strengthening ties with India:

- Decathlon plans to double sourcing from India to US $3 billion by 2030, focusing on technical textiles and high-growth categories (Reuters).

- ASICS India projects 35–37% YoY growth in revenue for 2024–25, supported by government-led local production expansion.

- TechnoSport, India’s fastest-growing sportswear and athleisure brand, achieved around ₹600 crore revenue in FY 2024–25 (Apparel Resources).

This momentum reflects a promising outlook for India’s sportswear MMF fabric market. However, the Government’s Quality Control Order (QCO) for the MMF supply chain has drawn mixed reactions, with concerns that it could restrict domestic fibre use. This raises critical questions: What makes MMF special? Why rely on imports? Why can’t India produce enough?

The Significance of Polyester Sportswear Fabric

Micro-denier polyester fibre has revolutionised global activewear and athleisure. It provides features such as moisture-wicking, sweat absorption, breathability, and dry comfort, all delivered through Dry-Fit polyester yarn (0.5–1.2 dpf).

This yarn is converted into woven or knitted fabrics for sportswear. India has mills that can process filament into fabric, and new investments under the PLI scheme (e.g., Shahi–Little King, TechnoSport) are advancing domestic fabric production. However, industry responses to QCO suggest that a large portion of filament yarn is still imported. The government’s goal is clear: build self-sufficiency in both yarn and fabric manufacturing.

Practical Considerations for Dry-Fit Fabrics

- Select correct dpf (0.5–1.2) for optimal hand-feel and moisture wicking. Example: 100D/144f → 0.69 dpf.

- Lightweight, smooth, quick-dry fabrics: Use FDY with high filament counts or POY drawn to FDY.

- Stretch, textured sportswear (jerseys/training wear): Choose DTY/PTY, offering bulk, sweat transport, and cotton-like comfort.

- For elasticity/four-way stretch: Combine textured yarns with elastane.

- Finishing: Hydrophilic, silicone softeners, and antimicrobial treatments are vital for performance.

Demand Landscape

Globally, the Big Five (Nike, Adidas, Puma, Lululemon, Under Armour) earned US $43.35 billion in apparel revenues in 2024–25. While India-specific figures are unavailable, homegrown brands are rapidly adopting Dry-Fit polyester. For instance, Amazon lists 11 such brands, Myntra 6, and Flipkart 10, reflecting strong demand.

India’s market requires 250,000–350,000 tonnes annually of Dry-Fit microfibre polyester (0.5–1.2 dpf), valued at US $500–700 million.

India’s Filament Manufacturing Capacity

Sportswear fabrics rely on POY, FDY, and DTY polyester filaments:

- POY: A versatile intermediate for producing DTY/FDY.

- FDY: Smooth, stable, ideal for lightweight jerseys/warp knits.

- DTY/PTY: Textured yarns, offering softness, stretch, and cotton-like feel, widely used in activewear.

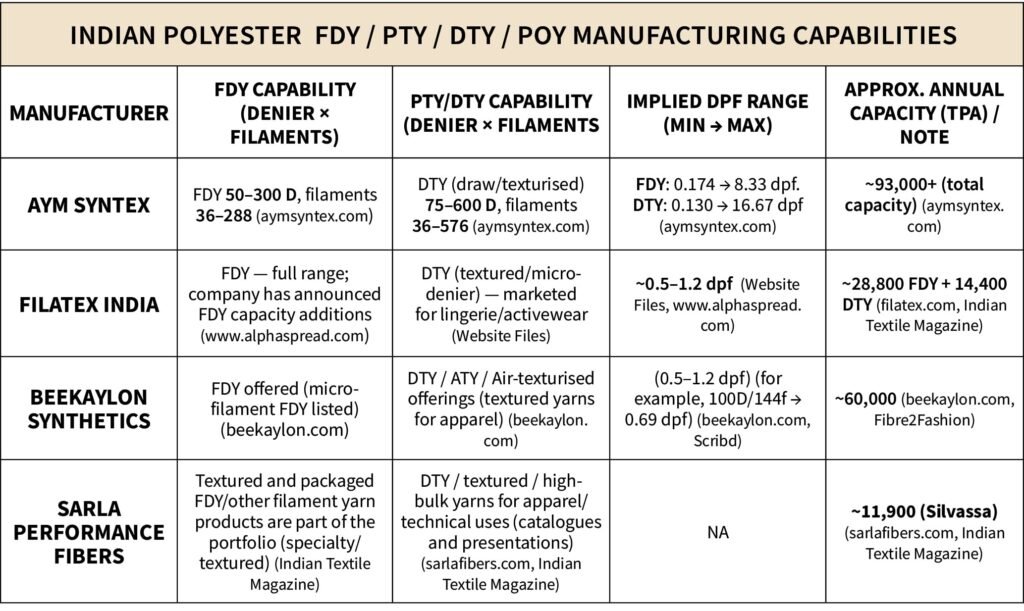

Reliance Industries produces around 2.5 million tonnes annually (FDY/DTY/POY combined), though it’s unclear how much is micro-denier (0.5–1.2 dpf). Other Indian manufacturers add another 200,000 tonnes annually, suggesting capacity exists, yet imports continue.

Scope for Expanding Domestic Capacity

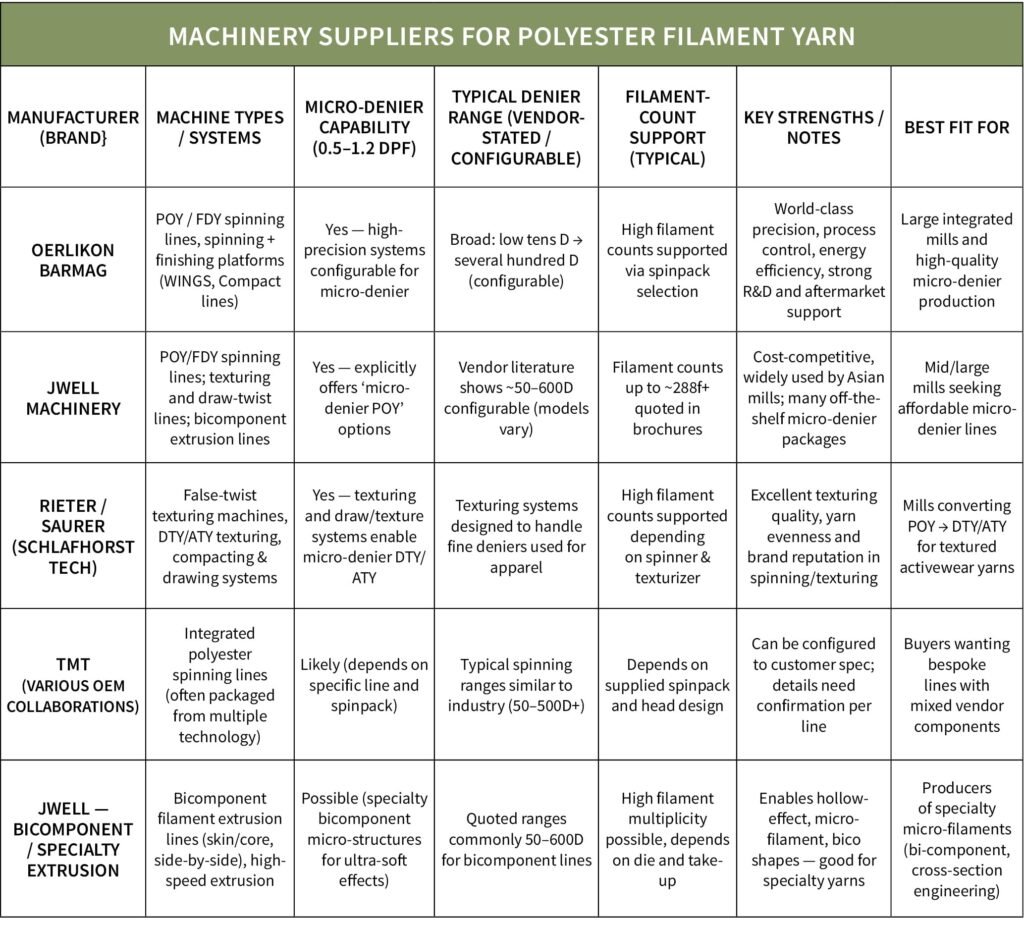

If India’s current production is unsuitable or directed to exports, imports remain necessary. Setting up new plants, however, is feasible. Globally, only four suppliers provide polyester filament machinery: Oerlikon Barmag, JWELL Machinery, Rieter/Saurer, and TMT (two Chinese, two European).

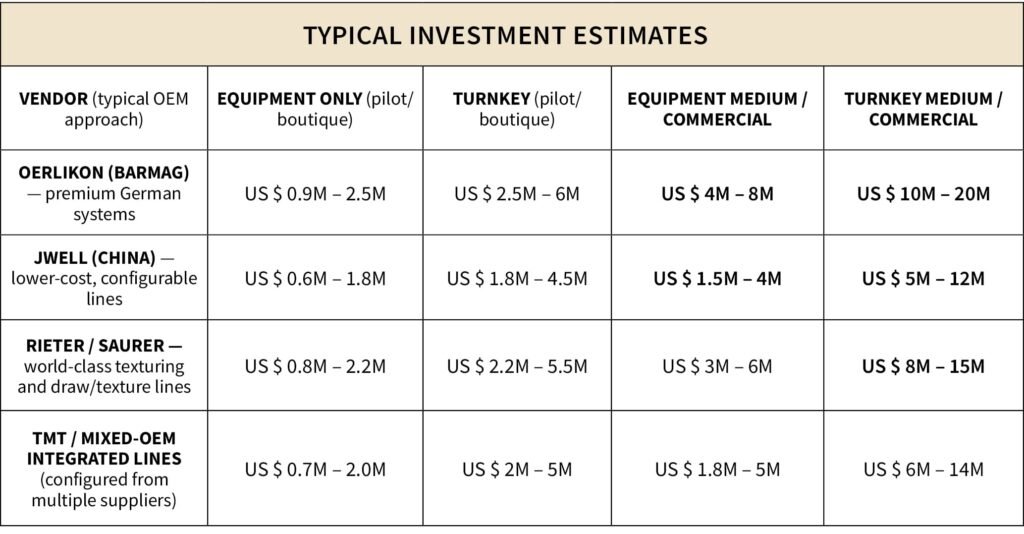

To establish a micro-denier filament plant, equipment such as extruders, spinpacks, POY/FDY spinners, texturing machines, and QC systems are required. Estimated capacities and investment:

- Small pilot/boutique plant: 1,200 TPA.

- Medium commercial plant: 6,000 TPA.

While Indian firms like Filatex, AYM Syntex, and Sri Durga Syntex are expanding capacity, clarity on micro-denier output is limited. Under the PLI scheme, 14 organisations have committed investments above ₹300 crore, suggesting feasibility. Yet, hesitation may stem from market uncertainty, demand scale, or expertise gaps.

The future of India’s sportswear fabric industry hinges on bridging this supply gap and reducing reliance on imports, while capitalising on its vast domestic and global market potential.