In summary

- India has set the lofty goal of obtaining 50% of its primary energy needs from renewable sources by India requires a large share of electric vehicles (EVs) and grid-level energy storage capacity in order to accomplish this.

- Because of the drawbacks of conventional batteries like lead-acid and nickel-metal hydride batteries, this anticipated shift would greatly boost India’s need for advanced chemistry batteries, especially lithium-ion (Li-ion) batteries. Compared to conventional battery chemistries, Li-ion battery chemistry has superior specific energy, power density, charging rate

- This expected change will significantly increase India’s demand for advanced chemistry batteries, particularly lithium-ion (Li-ion) batteries, due to the shortcomings of traditional batteries such as lead-acid and nickel-metal hydride batteries.

- Li-ion battery chemistry offers better specific energy, power density, and charging rate than traditional battery chemistries.

Presently, about all of India’s Li-ion battery needs are imported. But according to CareEdge Ratings,

- Despite a notable increase in demand brought on by the construction of large-scale integrated capacity for Li-ion battery storage, India’s reliance on imports is expected to decrease to about 20% by FY27.

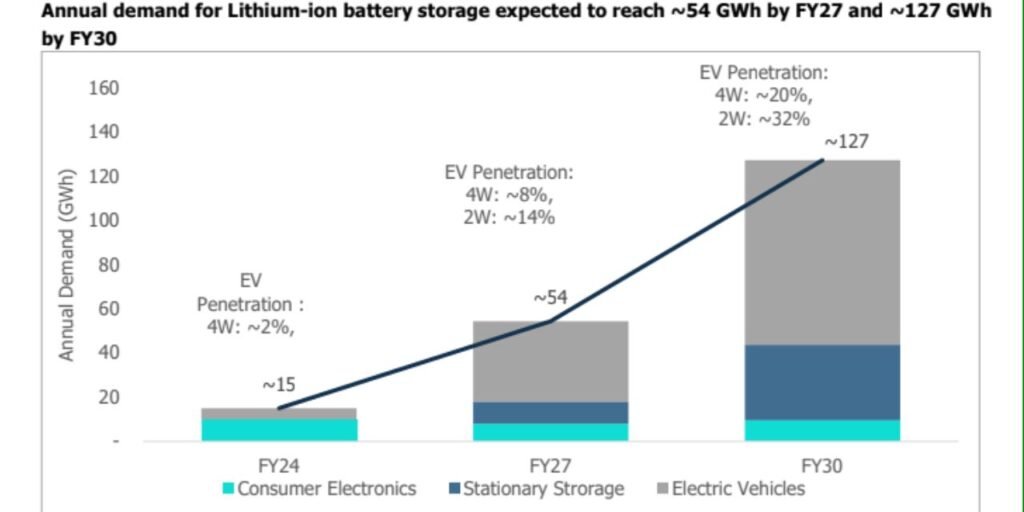

Currently, imports of lithium-ion cells and batteries account for nearly all of the local demand for lithium-ion battery storage, which is around 15 GWh. Li-ion battery consumption is predicted by CareEdge Ratings to increase rapidly to around 54 GWh by FY27 and then to about 127 GWh by FY30. The anticipated rise is the main factor driving the significant increase in demand. in EV adoption and electrical grid decarbonisation, bolstered by aggressive government goals and policies/incentives at the federal and state levels.

By lowering the cost of EVs and BESS, the Government of India has stimulated demand through a number of demand-side programs, including the Faster Adoption and Manufacturing of Electric Vehicles (FAME) program and the Viability Gap Funding (VGF) program for Battery Energy Storage Systems (BESS).

30% EV penetration (as a percentage of yearly sales) is the goal set by the Government of India by 2030. However, given the slower-than-expected EV adoption in the 4-wheeler market, customer preference for hybrid 4W vehicles, and the sluggish advancement of EV charging, CareEdge Ratings has projected a 20% EV penetration by FY30. infrastructure. By FY30, CareEdge Ratings projects that the total grid-level energy storage capacity for BESS will be around 100 GWh.

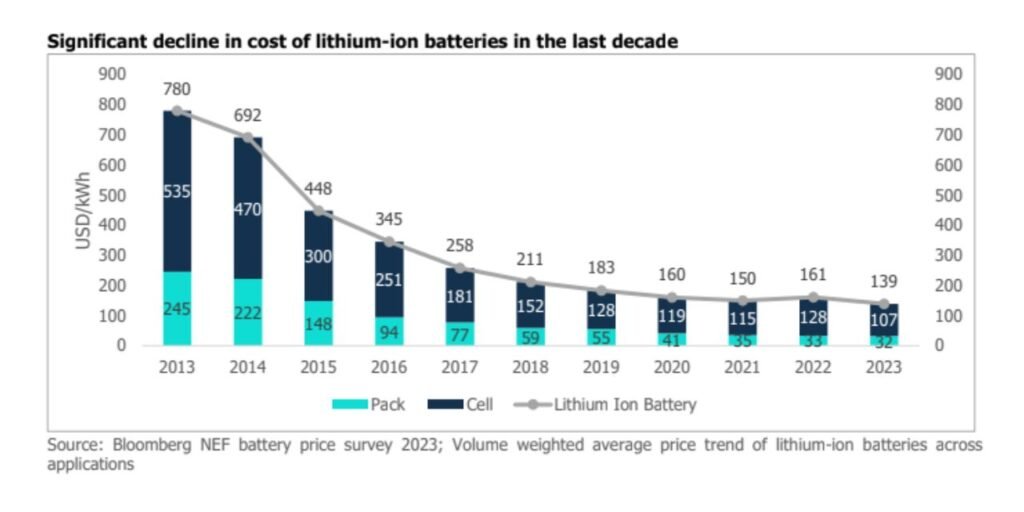

Due to increased economies of scale and technological advancements, the cost of lithium-ion batteries has decreased during the past ten years, ending in CY23. This has accelerated the adoption of these batteries by their end-use industries, leading to a notable increase in demand.

India’s reliance on imports will decrease when giga-scale integrated facilities come online.

Large-scale lithium-ion battery capacity expansion is anticipated to be supported by government policies and incentives, including the Advanced Chemistry Cell (ACC) Production Linked Incentive (PLI) program and many state

government incentives such interest subsidies, exemptions from stamp duty and power taxes, and capital subsidies. Under the PLI initiative, the GoI has already allotted 40 GWh of integrated battery capacity; the final 10 GWh are anticipated to be given soon. It is also anticipated that a small number of other Indian businesses and the country’s current conventional battery producers may establish battery capacity outside of the PLI plan. A significant percentage of these By FY27, it is anticipated that capacity would progressively come onstream. According to CareEdge Ratings, these capacity increases should reduce India’s reliance on imports to about 20% by FY27.

View of CareEdge Ratings

It is anticipated that India’s need for lithium-ion battery storage would increase dramatically due mostly to the country’s transition to electric vehicles and its need for renewable energy storage. India’s reliance on imports as a result is anticipated to drastically decrease from its current near-full dependency to about 20% by FY27 as a result of giga-size integrated battery capabilities coming online in India. Due to steadily falling prices brought on by developing technology, domestic capacity expansions for the production of lithium-ion batteries have so far advanced slowly. However, it is currently anticipated that local capacity for Li-ion battery manufacture will increase as a result of the realisation that the technology has now reached a fairly mature state.