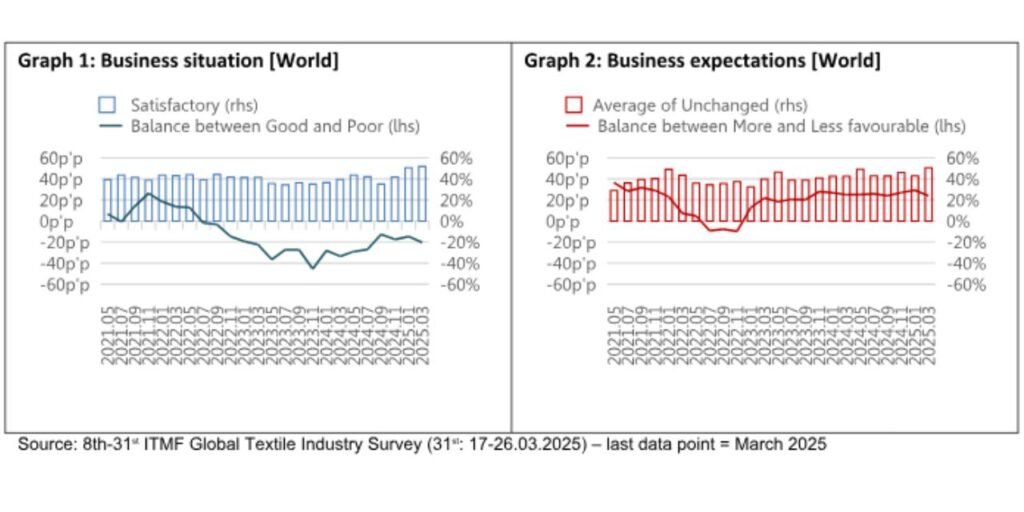

April 7, 2025 The Global Textile Industry Survey (GTIS) results for March 2025 have been made public by the International Textile Manufacturers Federation (ITMF). Regularly carried out throughout all significant areas and textile value chain segments, this survey found a complex depiction of a worsening business climate, cautious optimism, regional differences, and persistent structural difficulties.

The global business environment for the textile industry has somewhat worsened in March 2025, following a gradual but consistent recovery since November 2023. Although North and Central America and East Asia recorded slight gains, they are still at relatively low levels. Manufacturers of clothing maintained its most consistent performance throughout the value chain. Expectations for the fourth quarter of 2025 remained optimistic despite the present difficulties. East Asia stood out with a more gloomy perspective, whereas Africa and the Americas had the highest levels of optimism. Unlike technical and home textiles, where expectations were still low, producers of clothing, fibres, and finished fabrics were the most optimistic.

The previous order intake rebound had also stalled, with South-East Asia remaining largely flat while East Asia and Europe saw drops. When it came to sustaining order levels, garment manufacturers continued to do better than other industries. Backlogs of orders somewhat decreased to a 2.2 months on average worldwide, with Europe leading the way because of its large textile manufacturing sector. Due to comparatively higher rates in Asia, capacity utilisation remained stable at 73%. While garment manufacturers continued to maintain low stock levels due to prolonged market conservatism, textile inventories were beginning to rise, driven by yarn producers.

Concerns about demand and geopolitics were also still on the rise, according to the survey. 62% of respondents said that weak demand was still the most urgent concern, followed by geopolitical tensions (41%). Despite concerns about the price of energy and basic materials having somewhat decreased, worries about new sustainability rules and interest rates were growing. Please visit www.itmf.org or send an email to secretariat@itmf.org for additional information.