The CCI Group

With a greater focus on PM Gati Shakti’s digital infrastructure and its connection with Bharat Trade Net, this year’s budget makes a calculated strategic move that will lower trade-related expenses, expedite compliance procedures, and promote increased private sector involvement.

Additionally, supply chain management will become more transparent and efficient thanks to AI-driven logistics optimisation via the Unified Logistics Interface Platform (ULIP). We value the GST input tax credit rationalisation and the exclusion of some logistical services from indirect taxes, since these measures will greatly assist SMEs, enhance cash flow, and create an atmosphere that is more conducive to company expansion. Regarding sustainability, lowering import taxes on EV batteries, electric trucks, and hydrogen-powered cars can hasten the adoption of more environmentally friendly logistical practices and help create a cleaner environment.

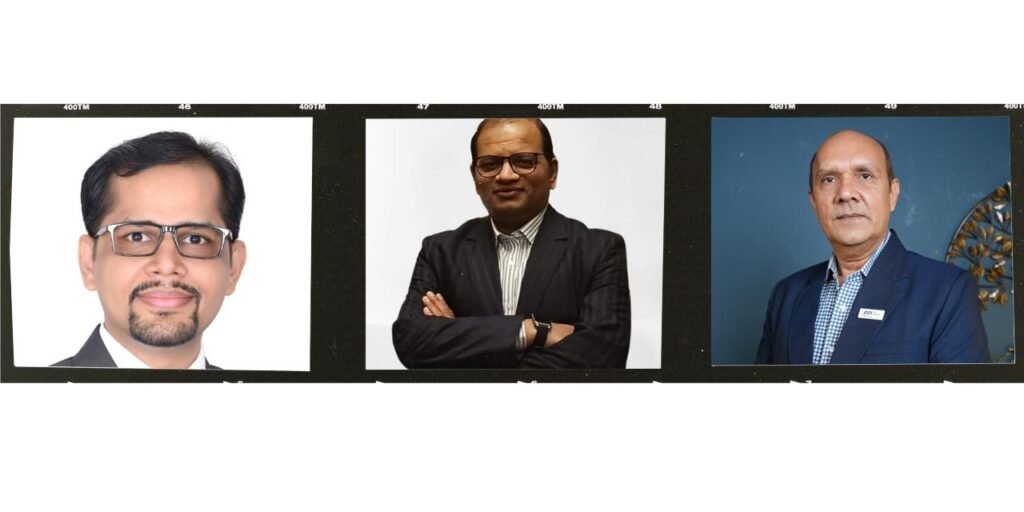

-Managing Director Naresh Sharma, CCI Group

KSH Distriparks

“The need for logistics will increase as the Union Budget 2025 boosts consumption while upholding budgetary restraint, and Inland Container Depots (ICDs) are essential to supplying these demands. The budget sets the stage for a more effective commerce environment by giving priority to the modernisation of air cargo facilities, improving storage for valuable perishables, and expediting customs procedures. The government wants to optimise the supply chain to drive cost-effectiveness, global competitiveness, and smooth operations, eventually advancing India’s journey towards “Viksit Bharat.” It is doing this by reaffirming its commitment to infrastructure development, digital transformation, and legislative changes.

Manoj Jhanwar, KSH Distriparks’ head of finance

Integrated Logistics KSH

“With its balanced approach to addressing the many facets of general development and boosting the economy, the Union Budget 2025 has hit all the appropriate notes. By giving the private sector chances to actively engage through PPP, EPC, and digital solutions, the budget is well-positioned to promote long-term growth.

A change in the logistics sector is shown by the government’s demand for private sector involvement with PM Gati Shakti. Route planning will be substantially improved, transit times will be shortened, and freight movement will be streamlined with the availability of pertinent, real-time data. Expanded MSMEs’ categorisation criteria and higher loan ceilings are crucial first steps in realising the sector’s full potential and securing India’s position as a major exporter and manufacturer in the world.

Additionally, SMEs in the industry will have more cash flow as some logistical services are free from indirect taxes. The expansion of cold chain infrastructure for perishable goods, especially for the pharmaceutical and agricultural sectors, and special incentives for private sector investments in warehousing, such as tax benefits for the development of logistics parks, will significantly boost the logistics industry as India establishes itself as a global hub for manufacturing and exports. Additionally, the burden of compliance will be lessened for logistics service providers as a result of the rationalisation of GST input tax credits. Through subsidies for EV adoption in the commercial vehicle market, namely for last-mile logistics and hydrogen-powered cars, the EV industry has received attention on the green front.