As per the recently published report by MarketsandMarkets™, The “Sterile Medical Packaging Market by Material (Plastic, Metal, Paper & paperboard, Glass), Type (Thermoform trays, Sterile bottles & containers, Pre-fillable inhalers), Sterilization Method, Application, and Region – Global Forecast to 2028″, is projected to grow from USD 57.5 billion in 2023 to USD 94.6 billion by 2028, at a CAGR of 10.5% from 2023 to 2028.

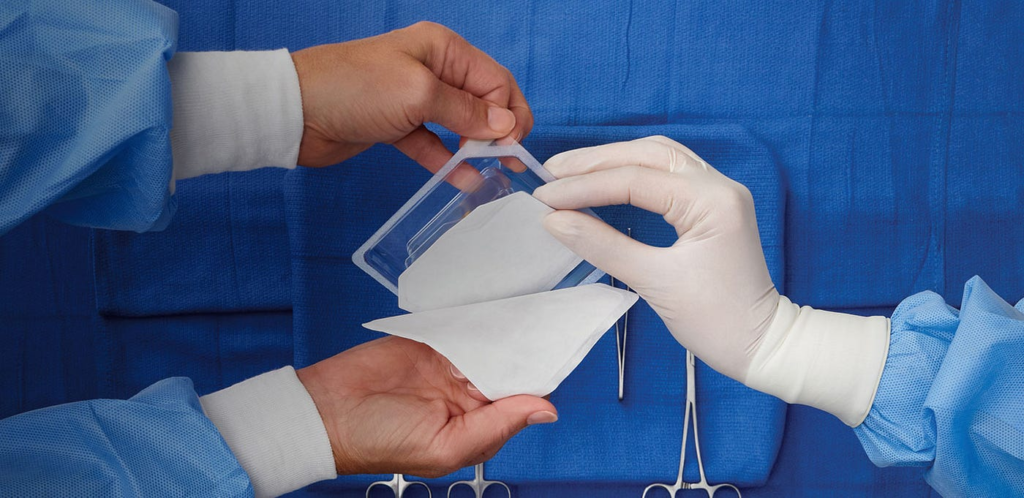

The demand for sterile medical packaging is propelled by advancements in packaging materials and technologies, such as the development of barrier films and aseptic packaging solutions, contribute to the market’s growth. The ongoing trend of single-use medical devices and the global focus on improving healthcare infrastructure further drive the demand for sterile medical packaging solutions, fostering innovation and market expansion.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=261270541

Browse

- 454 Market data Tables

- 56 Figures

- 342 Pages and in-depth TOC on “Sterile Medical Packaging Market – Global Forecast to 2028”

This report also provides a comprehensive analysis of the companies listed below:

The major players in sterile medical packaging market include Amcor plc (Switzerland), DuPont de Nemours, Inc. (US), Berry Global Group, Inc. (US), West Pharmaceutical Services, Inc. (US), and Sonoco Products Company (US) and others.

Merger & acquisitions, investments & expansions, partnerships & collaborations, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the sterile medical packaging market.

Recent Developments in Sterile Medical Packaging Market Industry

- In January 2023, Amcor plc announced an agreement to acquire Shanghai-based MDK Medical Packing Co., Ltd. (China).

- In August 2023, DuPont de Nemours, Inc. completed the acquisition of Spectrum Plastics Group (US), a recognized leader in specialty medical devices and components markets.

- In June 2019, DuPont de Nemours, Inc. invested more than USD 400 million to expand capacity for the manufacture of Tyvek at its facility in Luxembourg.

- In July 2023, Berry Global Group, Inc., collaborated with Deaconess Midtown Hospital, Nexus Circular, and Evansville Packaging Supply (US) to recycle non-hazardous, sterile, plastic packaging and nonwoven fabric from the hospital’s surgical suite, pharmaceutical packaging, laboratory, and warehouse.

- In December 2022, Berry Global Group, Inc. signed an agreement with Repsol to supply circular resins. These resins can be used for food and healthcare packaging.

- In February 2023, West Pharmaceutical Services, Inc. announced the expansion of its collaboration with Corning Inc. to include the exclusive distribution rights for Corning Valor Glass vials, and the launch of its first product, West Ready Pack with Corning Valor RTU Vials utilizing SG EZ-fill technology.

- In November 2022, Sonoco Products Company announced a definitive agreement to purchase the remaining equity interest in RTS Packaging, LLC (RTS) from joint venture partner WestRock Company (WestRock), and one WestRock paper mill in Chattanooga, Tennessee.

- In January 2020, Sonoco Products Company acquired Thermoform Engineered Quality, LLC and Plastique Holdings, Ltd; the new entity is known as is SONOCO TEQ.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=261270541

By Material, Plastic is expected to be largest material segment during the forecast period

Plastic materials dominate the sterile medical packaging market, holding the largest share, primarily due to their unparalleled versatility, cost-effectiveness, and adaptability to diverse packaging needs. Plastics offer a wide range of options, from traditional polymers to advanced, specialized formulations designed for sterile applications. Their ability to provide an effective barrier against contaminants, coupled with lightweight and durable characteristics, makes them ideal for packaging a variety of medical devices and pharmaceutical products.

By Type, Thermoform tray is expected to be largest segment during the forecast period

The trend towards single-use medical devices has propelled the demand for disposable and cost-effective packaging solutions, further boosting the popularity of thermoform trays in the sterile medical packaging market. The adaptability of thermoform trays to various product shapes and sizes, coupled with their enhanced protection and cost-effectiveness, positions them as a preferred choice, contributing to their accelerated growth in the industry.

The chemical sterilization method is expected to experience significant growth during the forecast period.

Chemical sterilization is particularly advantageous for heat-sensitive materials that may be compromised by traditional methods like steam sterilization. The method’s flexibility in accommodating various packaging formats, including complex and intricate devices, contributes to its widespread adoption. Moreover, the ability to achieve high sterilization efficacy while maintaining material integrity positions chemical sterilization as a crucial solution in the evolving landscape of sterile medical packaging. As regulatory standards evolve and industry demands for efficient, material-friendly sterilization methods increase, chemical sterilization stands out as a rapid and effective option, driving its prominence in the market.

By Application, Pharmaceutical & biological accounts for the largest application during the forecast period.

As advancements in medical research and development lead to a surge in specialized and sensitive pharmaceutical and biological products, the need for reliable and contaminant-free packaging becomes paramount. Sterile medical packaging ensures the integrity and sterility of these delicate substances, safeguarding them from external contaminants and environmental factors. The heightened emphasis on healthcare quality, coupled with the rise in biopharmaceutical innovations, positions pharmaceutical and biological applications at the forefront of the sterile medical packaging market, making it the fastest-growing segment as the industry strives to meet evolving standards and address the unique requirements of these critical sectors.

North America is the largest market during the forecast period.

Stringent regulatory standards and a strong emphasis on infection control contribute to the adoption of sophisticated sterile packaging technologies. The region’s proactive approach to incorporating innovative packaging materials and techniques, in response to evolving industry trends and consumer expectations, further propels its growth. As North America continues to witness technological advancements in the healthcare sector and an increasing focus on patient safety, the demand for sterile medical packaging solutions is on the rise, making it the fastest-growing market in the global landscape.